Have questions? Let us know!

Sign Up Below!

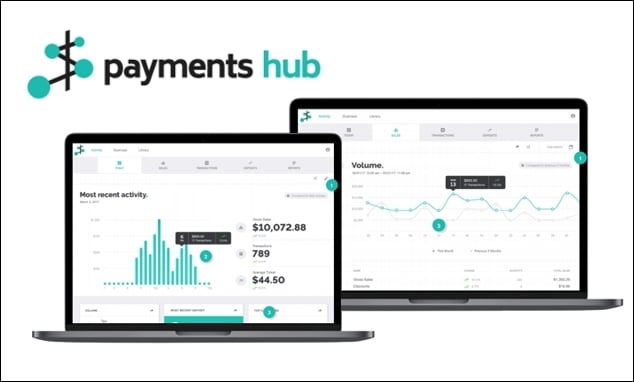

Welcome to our Paymentshub payment processing training session! In this hour, we'll provide you with a foundational understanding of our payment processing platform. We'll cover everything from navigating the dashboard to processing transactions, managing accounts, and understanding fraud prevention. Our goal is to equip you with the knowledge and skills you need to efficiently and confidently manage your payment processing.

This training session provides a comprehensive overview of the PayAnywhere platform, designed to equip you with the essential skills for efficient payment processing and business management. We will cover key areas such as system setup, general settings, transaction processing, and advanced features like inventory management and invoicing. By the end of this training, you will be able to confidently navigate PayAnywhere and utilize its tools to streamline your business operations.

.jpg?width=1275&height=1650&name=PH-page-001%20(1).jpg)

This training program provides an in-depth exploration of advanced invoicing techniques, designed to empower users with the knowledge and skills to efficiently manage and optimize their invoicing processes. Participants will learn to leverage various tools and platforms to generate invoices, create recurring billing cycles, automate payment collection, and streamline overall invoice management.

This training session offers essential guidance on navigating chargebacks and disputes. Participants will gain a clear understanding of what chargebacks are, how to prevent them, and how to manage them effectively through the portal. The session also provides valuable resources, including insights into refund policies, defense strategies, and helpful FAQs.

This 1-hour training program is designed to help you effectively manage your sales tax responsibilities and leverage automation tools. Section 1 covers essential tax information within your portal, including TIN matching, 1099-K forms, and best practices. Section 2 introduces Davo Tax Automation, a tool that simplifies the sales tax process by automating collection, filing, and payment.

All of our virtual training sessions are conducted via Google Meet and Microsoft Teams. You'll receive a link to join the session when you register.

An ISO, or Independent Sales Organization, is a company registered with Visa and Mastercard to sell and process bankcard transactions. It can also refer to an organization that works with and under the name of such a registered ISO.

No, ISOs rarely sell only bankcard services; they typically offer a broader range of products or services.

AVS stands for Address Verification System. It's an optional service designed to help protect against credit card fraud.

AVS verifies the identity of the person using a credit card by comparing the billing address provided by the user with the address on file at the credit card company.

A chargeback occurs when a cardholder's bank reverses all or part of a credit card transaction. This leaves the merchant financially responsible for the payment and potentially subject to penalties, unless they can prove they were not at fault.

Interchange is a fee paid by the merchant's bank (the card-acquiring bank) to the cardholder's bank (the card-issuing bank).